Rules regarding illness of an employee and the salary which has to be paid

This article discusses all the rules regarding the obligations of the employer and the sick employee.

This article discusses all the rules regarding the obligations of the employer and the sick employee.

Proposed changes for 2023 with respect to corporate tax, salary requirements and taxation of dividends for director-major shareholders

Since January 1, 2020, a 7% additional taxable benefit applies to the bicycle that the employer makes available to the employee for private usage.

How can an employer reimburse the travel costs and the costs of working from home for the employees tax free and what else can be paid untaxed.

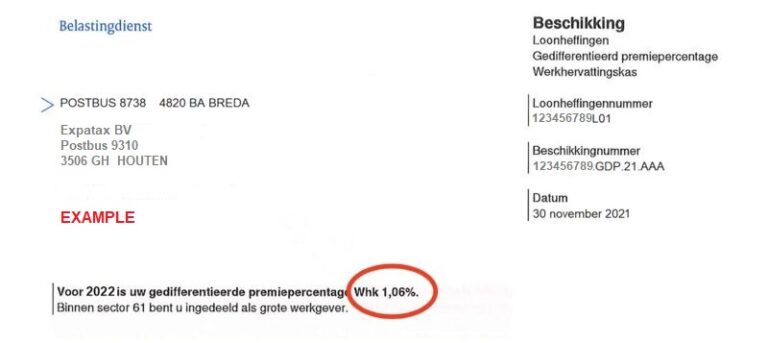

The Return-to-Work fund (“Werkhervattingskas or Whk”) is part of the employee insurance schemes. What is it and how is the premium calculated?

A higher payroll tax special rate is applied to all income in addition to the regular salary. What is it and how is it calculated?

Employer costs are the costs that an employer pays (in addition to the salary) for his employees.

In general an employee receives a payslip each month. But that is not always legally required.

Rules aroung work clothing with respect to wage tax, income tax and VAT

In the Netherlands we have the so called customary wage scheme which applies to director-major shareholders of a company.

In the wage tax declaration your employee indicates whether, and from what date, he wants to have the wage tax credit deducted.

An overview of the income tax rates, premiums social security and most common tax credits for 2022

Proposal is that as of 2024, the 30% ruling will be limited to a salary of a maximum of the Balkenende norm. In 2022 this was € 216,000.

Effective July 1, 2022, the statutory payment period of large companies to SMEs has been reduced from 60 days to 30 days.

If you start working in the Netherlands you will notice that your contract mentions a holiday allowance. But what is that, a holiday allowance, referred to as ‘Vakantiegeld’ in Dutch?

The employer can reimburse expenses occurred during a domestic or foreign business trip tax free based on the rate lists for civil servants.

Check whether the salary of a (foreign) employee using the 30% ruling meets the income standard of 2021. If this is not the case, the 30%-ruling will expire retroactive to January 1.

An employer can pay a tax free allowance to the employee to cover the costs of working from home.

A provisional assessment is an assessment based on an estimate of your income and expenses. It can be requested during the tax year to receive a refund earlier or to pay tax in advance.

A home internet subscription for which the employee must pay a personal contribution due to private use can fall under the targeted exemption.

This article explains how to register as an employer in the Netherlands and what information you will receive from the Dutch tax authorities.

A tax credit is a discount on the wage and income tax and/or premiums social security of an employee or person entitled to benefits. There are 8 tax credits.

Information about the tax rules around the reimbursements and benefits in kind for trips your employee makes for work. You will also find information about the provision of means of transport, public transport tickets and parking facilities.

Accruing your own (additional) pension In some situations it is necessary or sensible to build up additional pension yourself. How can you supplement your pension income yourself, and what are the tax benefits? In which situations is it wise to build up (extra) pension yourself? But even if you do accrue an employee pension, it…

How you should declare cryptocurrency in your Dutch tax return depends on your situation. These situations are described in this article.