Wage tax declaration, what and how?

Dutch word: loonbelastingverklaring

English translations: wage tax declaration, wage tax statement, payroll tax declaration, payroll tax statement. In this article we use the translation ‘wage tax declaration’.

New employees have to fill in a wage tax declaration. What is that, what do you need such a declaration for and where can you find such a declaration?

Are you taking on a new employee? Then you are legally obliged to request a number of details from him that are necessary for withholding the statutory payroll taxes. You then remit these levies to the tax authorities. These payroll taxes include:

- the wage tax,

- national insurance premiums,

- employee insurance contributions and the

- income-related contribution under the Health Insurance Act.

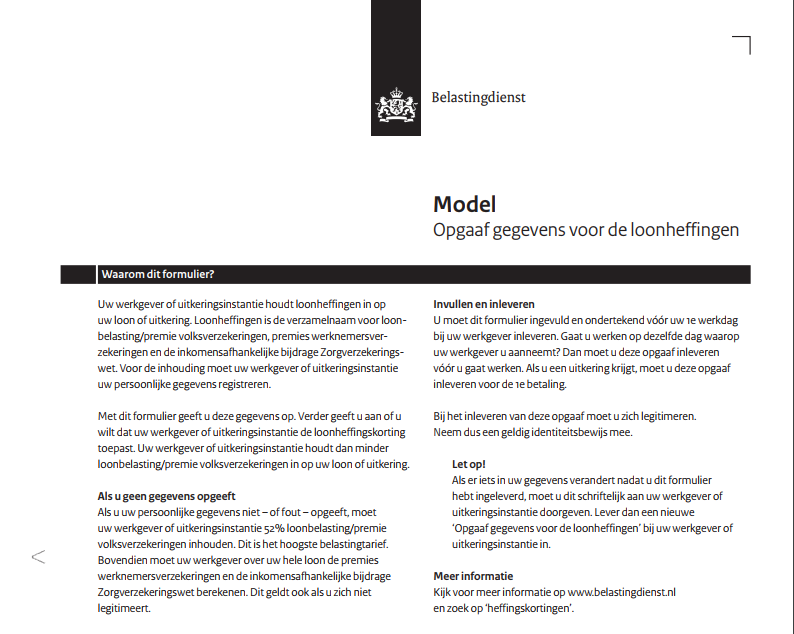

Wage tax declaration form

It is customary to request the required data from your employee using a special form provided by the tax authorities. The official name for this form is ‘Model Declaration of Data for Payroll Taxes’. But in popular speech it is also known as the ‘loonbelastingverklaring’ (wage tax declaration).

What is a wage tax declaration?

The wage tax declaration is a short form on which your employee indicates whether, and from what date, he wants to have the wage tax credit deducted. This is the amount by which the payroll tax is reduced. Based on the completed wage tax declaration, you can determine which payroll taxes and which tax credits you must apply to your new employee’s wages.

Your new employee only needs to answer three questions:

Question 1: Fill in personal details such as name, address and place of residence, date of birth and BSN.

Question 2: Indicate whether he wants you, as an employer, to take the statutory wage tax credit into account. And if so, from which date.

Question 3: Provide the form with the date and his signature.

Use your own model

Since January 1, 2007, as an employer you are no longer required to use the form provided by the tax authorities. You may also use your own model, as long as you record the required employee data.

In practice, however, many companies have continued to use the tax authorities’ form. We have translated the form of the tax authorities into English.

Wage tax declaration, when?

You must request the above information from a new employee before he starts working for you. At the latest one day before his first day of work you must have the necessary information. If the employee starts working on the day you hired him, the wage tax declaration must be filled in immediately before this first work.

Valid proof of identity

Together with the wage tax declaration the employee has to hand in a copy of a valid identity document. This is because you are required to establish his identity. You also have to check whether the information on the wage tax declaration corresponds with that on the identity document.

For more information see the article How should an employer record and verify the identity of its employees?

Wage tax declaration, how does it work?

Requesting, processing and storing the data of your future employee is very simple.

Only a few steps are required:

- Download a blank wage tax declaration here. We have translated it into English.

- Send the form to your employee, asking him to fill it in and sign it. Ask him to send it back before his employment contract takes effect and have him enclose a copy of a valid ID, or better yet, make a copy of this ID yourself.

- Check the employee’s identity and verify that all information has been filled in correctly.

- Keep the completed wage tax declaration with the payroll records.

Handle digitally

The tax authorities allow you to handle this administrative obligation digitally. You can therefore send the form to your employee on paper or digitally. He may even sign it digitally, as long as he uses a legally recognized electronic signature. However, the preference remains for a paper form with a wet signature.

Wage tax declaration not filled in or filled in incorrectly, what to do? Anonymous rate.

Based on the completed wage tax declaration you can determine which payroll taxes and which wage tax credits you have to apply to the salary of your new employee. A condition is that your employee has filled in the statement correctly and truthfully.

If employees provide incorrect information or do not return the wage tax declaration at all it is not possible to calculate the correct levies and credits. In such a case you must apply the so-called anonymous rate.

If you apply the anonymous rate to one (of your) employee(s) then:

- this means that you have to withhold 52 percent income tax and national insurance contributions from the salary of your employee.

- you must calculate the employee insurance premiums and the income-related healthcare insurance contributions over the entire salary. This is because the maximum premium wage for social security contributions may not be taken into account.

- no wage tax credit may be applied.

The anonymous rate also applies if your employee fails to identify himself.

If it turns out later that the anonymous rate has not been applied, you risk a fine of up to € 5,278!

What exactly is the wage tax credit?

The wage tax credit is actually a bundle of six tax credits. These all occur in the wage tax/premium national insurance. It is a discount that every employee working in the Netherlands can make use of. This also applies to people who do not live in the Netherlands. The discount is on the amount of premiums that you withhold from wages. If the employee is not fully liable to tax or social security contributions, this will of course also affect the discount you can receive.

General tax credit

The general tax credit is automatically calculated by you as the employer. If the partner of your employee does not use the entire tax credit, then the partner can, under certain conditions, receive part of it themselves via the income tax return.

For more information see the article about tax credits in the Dutch payroll administration.

Two jobs

If your employee has two jobs, he may only claim the wage tax credit for one job. He may never have double wage tax credits applied. For example, suppose this is a new employee who starts as early as March 20. His contract with his previous employer runs until March 31. Those eleven days are then overlapping. This means that he first does not apply any discount at your company and on April 1, he indicates that he does want to apply the discount. The discount can only be reversed or applied for on the first of the month.

If it should happen that an employee has forgotten to stop the wage tax credit with one of the employers, it is mandatory to repay the excess discount. They must arrange this individually with the tax authorities. In general, it is advisable to apply the wage tax credit to the job in which the employee is paid the most. That way they keep the most money.

If you know that your employee is also employed elsewhere where the employee receives his wage tax credit, you must issue a new wage tax declaration to the employee.

Retention obligation

The data must be kept for at least 5 calendar years, after the calendar year in which the employee left employment. However, the general tax retention period for entrepreneurs’ records is 7 years. We therefore recommend that the data be kept for 7 years.

Are you confused about Dutch payroll requirements? You don’t know what the regulations in the Netherlands are? You have no idea how your employees can be paid in Holland? How you can stay out of trouble with the tax authorities?

Don’t worry!

Expatax will help you

Use the contact form below to get in contact with us and ask your questions.

You will feel relieved once we have taken all the stress out of your company’s payroll, knowing that your employees are paid on time and payroll tax returns are filed correctly and on time.

Contact us if you need help with your Dutch payroll administration

Checklist when hiring a new employee

1. Before commencing work, establish the employee’s identity, nationality and residence status on the basis of an original prescribed valid identity document (e.g. Dutch passport, municipal identity card, permitted alien’s document). A driver’s license cannot be used for this identification.

2. Check the proof of identity referred to under 1. If it is false or forged, do not hire the employee. If you do, withhold income tax and national insurance contributions at the anonymous rate from the employee’s pay.

3. At the start of the work, include the nature, number and copy of the proof of identity referred to under 1 in the payroll records.

4. Ensure that the employee completes, signs and submits a wage tax declaration to you prior to the first paycheck.

5. Check the wage tax declaration. If you know that the name, address and/or residence details are incorrect, do not hire the employee. If you do, withhold income tax/ national insurance contributions at the anonymous rate from the employee’s salary.

6. Keep the copy of the proof of identity referred to under 1 with your payroll records for at least 5 (or 7) years after the calendar year in which the employment ended.

7. Keep the wage tax declaration referred to in 4 with your payroll records for at least 5 (or 7) years after the year in which the employment is terminated or in which a new wage tax declaration is submitted.

8. Ensure that the employee can always identify himself at the workplace by means of an original prescribed valid identity document (in addition to the documents referred to under 1, this can also be done by means of a Dutch driver’s license).