30% ruling becomes 27% ruling – higher salary requirements

The 30% ruling will be reduced to a 27% ruling as of 1 Jnauary 2027. Also the required salary will increase.

The 30% ruling will be reduced to a 27% ruling as of 1 Jnauary 2027. Also the required salary will increase.

Tax Plan 2025 mentions that the 30% ruling is changed to a 27% ruling but without further reduction of the percentage.

The work-related costs scheme allows an employer, to give tax-free reimbursements for fitness to the employees.

You would like to give your employees a gift with their birthday. Is it possible to give the birthday gift tax-free?

Do you employ workers with a low salary? If so, you may be entitled to an allowance for labour costs: the low-income benefit (LIV).

Did the employer exceed the free space of the work-related costs scheme in 2023? Then you must declare the final levy due no later than in the wage tax return for the 2nd period of 2024.

As of 1 January 2024, the 30% ruling changed in several areas

What are the rules in the Netherlands around the preparation, adoption and publication of the annual report?

The amount an employer can give an employee per business kilometre tax-free will increase from €0.21 to €0.23 from 1 January 2024.

This guide tells you when to apply the anonymous rate and how to process this in the payroll tax return

Employee insurance protects salaried employees against loss of income. The premiums are paid by the employer.

A targeted exemption applies to discounts on products from the employer’s own company. Three conditions must be met.

Can costs of food and beverage be deducted from the business profit and can the VAT be claimed back?

In this article, we will discuss when an employee is entitled to transition compensation and how to calculate the transition compensation.

A temporary contract ends automatically on the agreed end date. What are the tax and legal rules regarding a fixed term contract?

Do you have doubts about your current payroll? We may be able to take over your payroll. But what is the right time to transfer your payroll to us?

What taxes do you have to deal with as an entrepreneur? What deductions are there for entrepreneurs? Which tax breaks can you use to your advantage as a self-employed person?

The work-related costs scheme is a tax regulation under which the allowances and benefits in kind that employers give to their employees can remain tax-free to a certain extent.

The new rules for withholding and paying of payroll taxes as of January 1, 2023

This article discusses all the rules regarding the obligations of the employer and the sick employee.

Proposed changes for 2023 with respect to corporate tax, salary requirements and taxation of dividends for director-major shareholders

Since January 1, 2020, a 7% additional taxable benefit applies to the bicycle that the employer makes available to the employee for private usage.

How can an employer reimburse the travel costs and the costs of working from home for the employees tax free and what else can be paid untaxed.

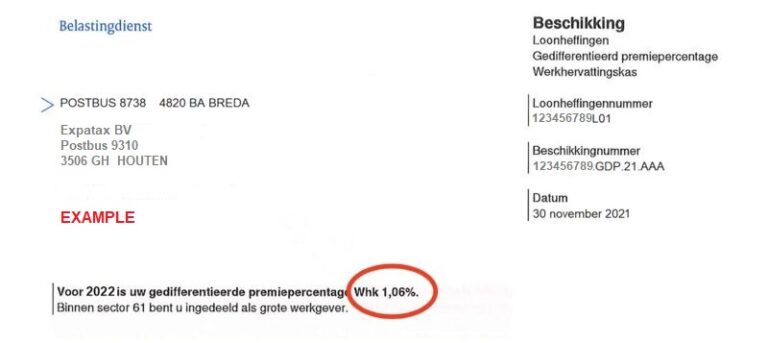

The Return-to-Work fund (“Werkhervattingskas or Whk”) is part of the employee insurance schemes. What is it and how is the premium calculated?

A higher payroll tax special rate is applied to all income in addition to the regular salary. What is it and how is it calculated?