Payroll administration in the Netherlands

Dutch payroll administration

If you employ people in the Netherlands or send employees to work here on assignment, then you may have to set up a Dutch payroll administration. Expatax can help you. We can reduce the stress of maintaining a payroll administration in the Netherlands for you. Your company will save on internal costs of paperwork, software updates and complex payroll calculations. More importantly, you will prevent discussions with the Dutch tax authorities and your employees and no penalties. Ease of mind. And we are already doing this for more than 20 years!

You have a company in the Netherlands

If you have a company in the Netherlands where you employ people then these employees will be placed on the Dutch payroll administration. Due to the physical presence all employees automatically fall under the Dutch tax rules.

You send employees to work in the Netherlands

All foreign companies which send people to work on assignment in the Netherlands (or hire employees who already live in the Netherlands) are deemed to have ‘fictitious residence’ in the Netherlands for tax purposes. This means that all employees on assignment in the Netherlands are subject to Dutch income tax liability from day one of such an assignment; unless an applicable tax treaty states that the salary will remain taxable in the country of origin, though that is rarely the case because the Dutch tax authorities are very reserved on that matter.

To prevent that the client will have to take care of the payroll, it is important that the foreign employer arranges the payroll administration in the Netherlands and makes sure that every month the right amount of wage tax and premiums for the social security are withheld and paid. If a foreign company doesn’t follow the Dutch rules the client for whom the employees are working in the Netherlands can be held liable for the wage tax debt, premiums social security and possible fines. This can lead to serious consequences for everybody involved.

Expatax will register your company as a foreign withholding agent with the Dutch tax authorities. This registration will only be for wage tax and social security.

What can Expatax do for you?

Expatax can assist you with the whole procedure, including but not limited to:

- Registration with the Dutch tax authorities for wage tax and social security

- Creation of employment contracts

- Application of the 30% ruling (if applicable)

- Calculation of monthly salary and creation of payslips

- Advice about the available tax free allowances

- Submission of wage tax returns

- Correspondence with involved parties

- Annual accounts, administration and year end statements

- Creation of payment schedule for wage tax, national insurances and net wages

- Take care of the payments to your employees and the tax authorities (and if applicable the pension provider)

Why should you outsource your Dutch payroll administration?

Request a price quotation or ask a question

As no business is the same, we take a close look at your requirements, we take care in planning the payroll service to suit your existing internal systems. Your company will save on internal costs of paperwork, software updates and complex payroll calculations which should be taken into account when evaluating the service. Please contact us to discuss the possibilities and receive a quote based on your situation and needs. You can also download our brochure for more information about our services, setting up a payroll administration in the Netherlands and the information which is required to register your company as an employer with the tax authorities and to get your employees on the Dutch payroll.

Be advised that we don’t offer payrolling solutions which means that we can’t act as an employer for individual contractors. We can only take care of the salary administration for foreign or Dutch based employers with employees in the Netherlands. The employer will be our client, not the employee or contractor.

Are you confused about Dutch payroll requirements? You don’t know what the regulations in the Netherlands are? You have no idea how your employees can be paid in Holland? How you can stay out of trouble with the tax authorities?

Don’t worry!

Expatax will help you

Use the contact form above to get in contact with us and ask your questions.

You will feel relieved once we have taken all the stress out of your company’s payroll, knowing that your employees are paid on time and payroll tax returns are filed correctly and on time.

Wo do we work for?

Sectors

Our clients work in various sectors like IT, finance, trade, oil & gas, non-profit, internet, etc. Every sector has its own characteristics. We are providing payroll services since 2003, our experience is broad.

Sizes

Our clients range from one person companies to multinationals. We work for the biggest companies in the world but also for small businesses. We are familiar with your requirements.

Countries

Our clients come from all over the world. Some clients are already doing business in the Netherlands for many years, others have just decided to take the first step. We provide all reports and communication in English.

Relevant posts

30% ruling becomes 27% ruling – higher salary requirements

The 30% ruling will be reduced to a 27% ruling as of 1 Jnauary 2027. Also the required salary will increase.

From 30% ruling to 27% ruling – review expat ruling

Tax Plan 2025 mentions that the 30% ruling is changed to a 27% ruling but without further reduction of the percentage.

Can I offer fitness to my employees tax-free?

The work-related costs scheme allows an employer, to give tax-free reimbursements for fitness to the employees.

How is a birthday gift to your employee treated for tax purposes?

You would like to give your employees a gift with their birthday. Is it possible to give the birthday gift tax-free?

Low income benefit (LIV)

Do you employ workers with a low salary? If so, you may be entitled to an allowance for labour costs: the low-income benefit (LIV).

Final levy WKR 2023 to be declared in 2nd return period 2024 at the latest

Did the employer exceed the free space of the work-related costs scheme in 2023? Then you must declare the final levy due no later than in the wage tax return for the 2nd period of 2024.

The 30% ruling in 2024 – what has changed?

As of 1 January 2024, the 30% ruling changed in several areas

Tax-free travel allowance increased to EUR 0.23 per km as of 2024

The amount an employer can give an employee per business kilometre tax-free will increase from €0.21 to €0.23 from 1 January 2024.

Application of anonymous rate in the payroll administration

This guide tells you when to apply the anonymous rate and how to process this in the payroll tax return

Employee insurance contributions which are paid by the employer

Employee insurance protects salaried employees against loss of income. The premiums are paid by the employer.

Untaxed discount for products from employer’s own company

A targeted exemption applies to discounts on products from the employer’s own company. Three conditions must be met.

What is a transition compensation and how is it calculated?

In this article, we will discuss when an employee is entitled to transition compensation and how to calculate the transition compensation.

Fixed-term or defined employment contract ends by operation of law

A temporary contract ends automatically on the agreed end date. What are the tax and legal rules regarding a fixed term contract?

We can take over your existing payroll

Do you have doubts about your current payroll? We may be able to take over your payroll. But what is the right time to transfer your payroll to us?

The work-related costs scheme (WKR)

The work-related costs scheme is a tax regulation under which the allowances and benefits in kind that employers give to their employees can remain tax-free to a certain extent.

Changes related to your payroll administration in 2023

The new rules for withholding and paying of payroll taxes as of January 1, 2023

Rules regarding illness of an employee and the salary which has to be paid

This article discusses all the rules regarding the obligations of the employer and the sick employee.

Higher tax for a director-major shareholder in 2023

Proposed changes for 2023 with respect to corporate tax, salary requirements and taxation of dividends for director-major shareholders

How is a company bicycle which is made available to the employee taxed?

Since January 1, 2020, a 7% additional taxable benefit applies to the bicycle that the employer makes available to the employee for private usage.

Travel allowance and work from home allowance

How can an employer reimburse the travel costs and the costs of working from home for the employees tax free and what else can be paid untaxed.

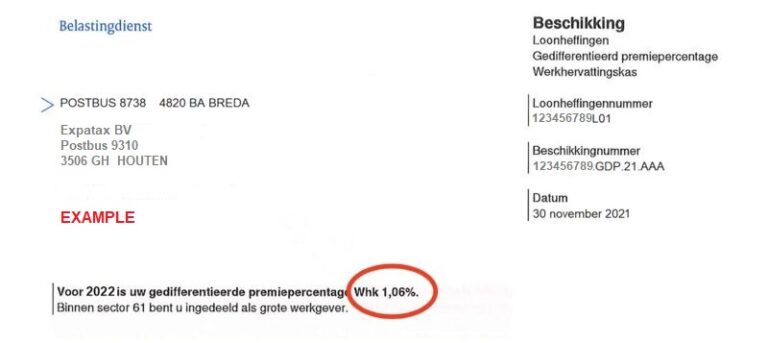

What does the Return-to-Work fund (Werkhervattingskas or Whk) entail?

The Return-to-Work fund (“Werkhervattingskas or Whk”) is part of the employee insurance schemes. What is it and how is the premium calculated?

As an employer, what do I need to know about the payroll tax special rate?

A higher payroll tax special rate is applied to all income in addition to the regular salary. What is it and how is it calculated?

What does an employee cost? Calculate the employer costs

Employer costs are the costs that an employer pays (in addition to the salary) for his employees.

Is an employer required by law to provide a payslip each month?

In general an employee receives a payslip each month. But that is not always legally required.

What are the tax rules surrounding the reimbursement and provision of work clothing?

Rules aroung work clothing with respect to wage tax, income tax and VAT

The customary wage scheme for director-major shareholders

In the Netherlands we have the so called customary wage scheme which applies to director-major shareholders of a company.

Wage tax declaration, what and how?

In the wage tax declaration your employee indicates whether, and from what date, he wants to have the wage tax credit deducted.

Holiday allowance in the Netherlands

If you start working in the Netherlands you will notice that your contract mentions a holiday allowance. But what is that, a holiday allowance, referred to as ‘Vakantiegeld’ in Dutch?

Reimbursement of expenses for domestic and foreign business trips 2022

The employer can reimburse expenses occurred during a domestic or foreign business trip tax free based on the rate lists for civil servants.

End-of-year check on salary expats

Check whether the salary of a (foreign) employee using the 30% ruling meets the income standard of 2021. If this is not the case, the 30%-ruling will expire retroactive to January 1.