Are you looking for help with your administration and tax? And you are a freelancer, self employed, sole proprietorship, one (wo)man business, zzp or any other type of independent entrepreneur?

Being independent you have more freedom to arrange your work and to benefit of certain tax benefits. You love what you are doing.

But are you worried that:

- you will have to take care of your own taxes,

- you will need to make sure that your administration is up to date,

- VAT returns are filed properly,

- the correct taxable income is declared in your personal tax return,

- the applicable tax credits and deductions are claimed,

- you are not in control?

Don’t worry, Expatax is here to help you!

Our packages

Freelancer

Monthly

€ 80 *

- We take care of your administration

- Preparation and filing of VAT returns

- Year end accounts

- Personal income tax return

- Time extension for the tax return

- Check of tax assessments

- Answering administration related questions by email and telephone (specific advice may be charged separately)

- Online access to your administration and the option to create sales invoices (+€ 15)

VOF / Partnership

Monthly

€ 125 *

- We take care of your administration

- Preparation and filing of VAT returns

- Year end accounts

- Personal income tax return

- Time extension for the tax return

- Check of tax assessments

- Answering administration related questions by email and telephone (specific advice may be charged separately)

- Online access to your administration and the option to create sales invoices (+€ 15)

BV / Limited company

Monthly

€ 180 *

- We take care of your administration

- Preparation and filing of VAT returns

- Year end accounts

- Personal and corporate income tax return

- Time extension for the tax returns

- Check of tax assessments

- Answering administration related questions by email and telephone (specific advice may be charged separately)

- Online access to your administration and the option to create sales invoices (+€ 15)

- Payroll administration: € 12,50 per employee

* Conditions

- Monthly fee is an indication based on an average administration (20 transactions per month). A higher fee may be applicable if you have more transactions or due to the complexity of the administration (for example cash payments or use of online payment providers like Paypal/Stripe/Mollie). This will be discussed with you in advance.

- Additional services will be charged based on the hourly rate. The applicable rate will be discussed with you before any work is done.

- The package is based on a full tax year and charged in monthly installments. In case you start during the tax year the annual total fee will be adjusted with respect to the preparation of VAT returns and processing of the administration.

- All amounts are excluding VAT.

- By hiring Expatax you agree with our terms and conditions.

Download our brochure about becoming self-employed

This brochure contains a lot of information about becoming a freelancer:

Registration

Income tax

Criteria to determine self employment

Tax resident and world wide income

Tax number

Self employed tax deductions

Deductible expenses

VAT and VAT return

Deadline

VAT on invoices

How to become our client

Grip on your figures

We work with Exact Online, the number 1 software for ambitious entrepreneurs and advisors.

To facilitate cooperation with us, we use MyExpatax. This handy software, offered by Exact Online, provides insight into your financial position. Anytime, anywhere, wherever you are. Lightning fast, real-time and without hassle. Check the status of an invoice and check the cash flow while you are talking. No difficult spreadsheets, unclear e-mail changes or cumbersome working methods, but clear graphs and relevant key figures that help you make the right decision at any time.

This is what you can do with MyExpatax

Deliver documents

Take a picture of the receipt immediately with the app on your smartphone and you don’t have to think about it anymore. Upload your invoices very easily via MyExpatax and they will be sent directly to your administration. Approve or reject them for payment and make the payments via the clear payment list.

Clear communication

Missing documents? Questions about purchase and sales invoices? With MyExpatax you can see at a glance what the question relates to, thanks to the chat function that is linked to the booking or invoice in question.

Relevant insight

Online overview of everything that still has to be paid and directly make the payment from MyExpatax. That way, the accounting is immediately up-to-date and you have an up-to-date picture of your financial position.

Optional: create and send invoices

The sooner the invoice reaches the customer, the sooner that invoice will be paid to you. Create the invoice easily via the computer, or directly via the app on your smartphone and they will immediately be in your customer’s e-mail.

Stop worrying about your administration!

Let expatax help your with your bookkeeping and tax obligations.

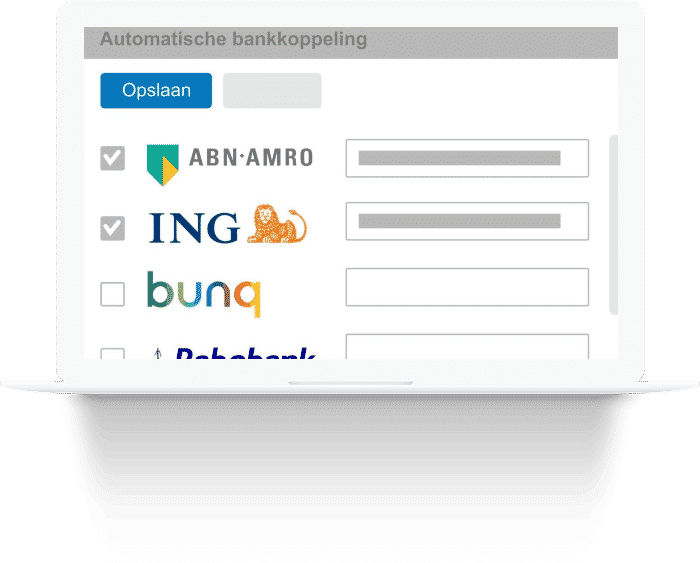

Automatic bank connection

We can link your professional bank account with your administration. This way your administration will be up to date and you can follow your bank transactions in MyExpatax. You don’t have to provide bank statements as PDF or CSV to us which saves you time and prevents that bank statements are missing.

We can link bank accounts from Rabobank, ABN Amro, ING, Knab and bunq.

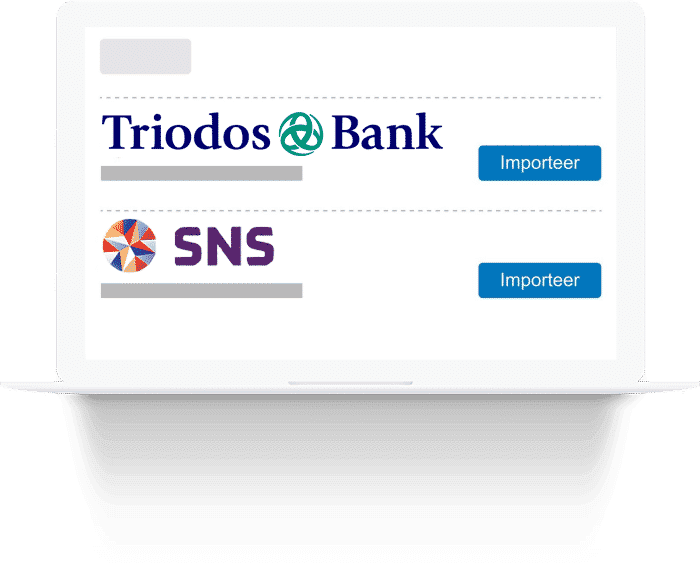

Import bank statements from other banks

Bank statements from other banks can be imported manually in your administration by downloading so called MT940 files in your internet banking environment. This way we can also keep your bank transactions up to date but it is not as confortable as the automatic bank connection.

Why Expatax?

Expat focus

Specialised in assisting expats in the Netherlands doing business world wide

One point of contact

The same consultant handling all aspects of your case.

Experience

Over 20 years of experience in dealing with sole proprieters and freelancers.

Affordable prices

We offer packages which include all our services.

Expatax is certified user of the following administration software

Become our client

Register yourself here as a freelance client with Expatax. We will then contact you further to discuss the next steps. For our package and what it includes please see below.

Legislation

Tax and social security

Freelancers and entrepreneurs have to pay turnover tax (VAT) and income tax. If you work as a freelancer and are considered to be self-employed, your client does not have to deduct wage tax from your freelance payments.

Every quarter a VAT return must be filed. VAT is very complex. We can help you with taking care of your VAT obligations.

Your freelance income is taxed with income tax. The income will have to be declared with your other income in the annual income tax return. Expatax will file this for you too as part of our Freelancer packages.

If you work as a freelancer and are considered to be self-employed, your client does not have to deduct social security premiums from your freelance payments. If you are not considered to be self-employed, your client does have to deduct social security premiums.

Deductible business expenses

Any expense which is ordinary and necessary for your trade or business is deductible. Not all expenses, however, are fully deductible. Some examples of fully deductible expenses are accounting fees, insurance, office rent, telephone and internet expenses. Examples of expenses that are only partially deductible are car expenses and dining with clients. Expatax can help you with which of your expenses are fully, partially or non-deductible.

Administration

If you are working as a freelancer you must keep an administration, file VAT returns and file the annual income tax return. This is not easy and can be very time consuming so let Expatax take care of it for you so that you can invest your valuable time into your profession instead.

Be sure to check our Knowledge Base for articles about working as a freelancer in the Netherlands.

Everything digital

You can easily hand over your administration to Expatax digitally. Your administration can stay up to date this way.

Self employed – Sole proprietorship – One man business – ZZP – Freelancer

These are all words to describe that you are working independently. But they all mean the same and have the same tax and bookkeeping consequences.

Stop worrying about your administration!

Let expatax help your with your bookkeeping and tax obligations.