30% ruling becomes 27% ruling – higher salary requirements

The 30% ruling will be reduced to a 27% ruling as of 1 Jnauary 2027. Also the required salary will increase.

The 30% ruling will be reduced to a 27% ruling as of 1 Jnauary 2027. Also the required salary will increase.

Tax Plan 2025 mentions that the 30% ruling is changed to a 27% ruling but without further reduction of the percentage.

The work-related costs scheme allows an employer, to give tax-free reimbursements for fitness to the employees.

Do you employ workers with a low salary? If so, you may be entitled to an allowance for labour costs: the low-income benefit (LIV).

Did the employer exceed the free space of the work-related costs scheme in 2023? Then you must declare the final levy due no later than in the wage tax return for the 2nd period of 2024.

Employee insurance protects salaried employees against loss of income. The premiums are paid by the employer.

A targeted exemption applies to discounts on products from the employer’s own company. Three conditions must be met.

In this article, we will discuss when an employee is entitled to transition compensation and how to calculate the transition compensation.

The work-related costs scheme is a tax regulation under which the allowances and benefits in kind that employers give to their employees can remain tax-free to a certain extent.

The new rules for withholding and paying of payroll taxes as of January 1, 2023

How can an employer reimburse the travel costs and the costs of working from home for the employees tax free and what else can be paid untaxed.

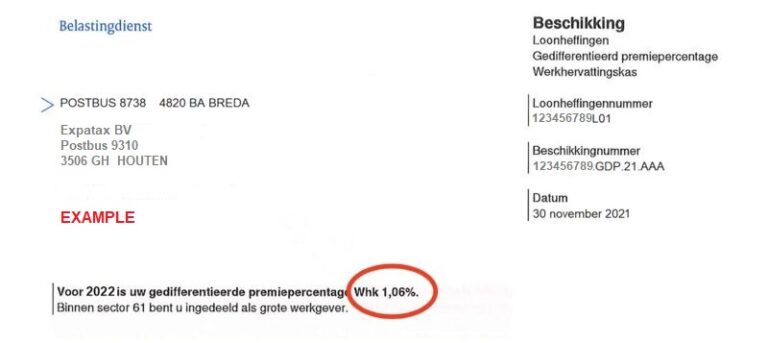

The Return-to-Work fund (“Werkhervattingskas or Whk”) is part of the employee insurance schemes. What is it and how is the premium calculated?

A higher payroll tax special rate is applied to all income in addition to the regular salary. What is it and how is it calculated?

Employer costs are the costs that an employer pays (in addition to the salary) for his employees.

In general an employee receives a payslip each month. But that is not always legally required.

Rules aroung work clothing with respect to wage tax, income tax and VAT

In the Netherlands we have the so called customary wage scheme which applies to director-major shareholders of a company.

In the wage tax declaration your employee indicates whether, and from what date, he wants to have the wage tax credit deducted.

A home internet subscription for which the employee must pay a personal contribution due to private use can fall under the targeted exemption.

This article explains how to register as an employer in the Netherlands and what information you will receive from the Dutch tax authorities.

A tax credit is a discount on the wage and income tax and/or premiums social security of an employee or person entitled to benefits. There are 8 tax credits.

Information about the tax rules around the reimbursements and benefits in kind for trips your employee makes for work. You will also find information about the provision of means of transport, public transport tickets and parking facilities.

Outsourcing your payroll administration mainly provides time, convenience, expertise, cost savings and risk limitation. You can opt for complete outsourcing of payroll administration, or for a hybrid solution, in which you do part yourself and outsource another part.

Tax on wages and salaries Tax payable by Persons resident in the Netherlands receiving a wage or salary from an employer established in the Netherlands for work they are doing or have done. Persons resident abroad receiving a wage or salary from an employer established in the Netherlands for work they are doing or have done in…